Risk Trends Return To Markets

The end of last week saw strong risk-averse moves across all financial markets as the situation in the Ukraine escalated. The wider ramifications of European and Russian tensions over the region saw a broad flight to safety as investors moved away from holding riskier assets over the weekend.

It is likely that these broad fundamental risk trends will continue to dominate the market this week unless a quick resolution is reached to end the current tensions. With what promises to be a busy schedule of economic releases this week is measuring up to be one in which volatility is likely to be the order of the day.

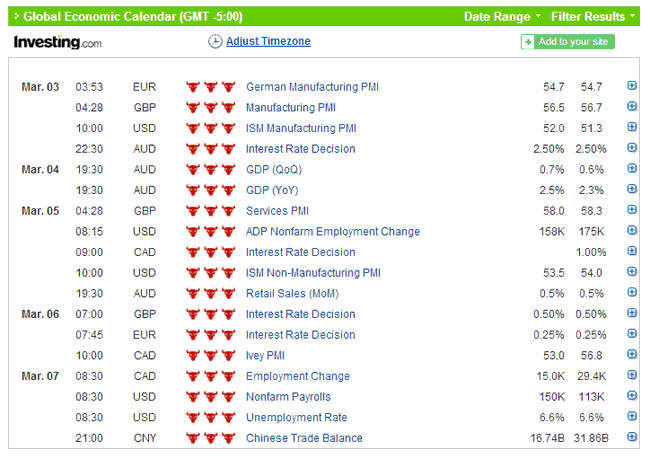

Rate decisions dominate the week which also sees a wealth of key manufacturing data up for release. The Royal Bank of Australia, Bank of Canada, Bank of England and European Central Bank are all set to release their latest rate statements to the markets. Of these the Bank of England announcement could prove the most interesting as further pressures for a rate rise come into focus.

Later in the week focus will once again turn to the US Non-Farm Payrolls report. While US Stock Indices have been rising steadily the Dollars latest rally has been stalled by the latest risk of tones in the markets. Traders will be looking to see if the latest employment figures can precipitate a new rally.

On commodity markets Gold has struggled to maintain its recent rally and now looks ready to pause for breath. Demand has dropped and it seems that even risk averse investors are no longer flocking to this safe-haven as readily as they once would have.

Key News This Week

Forex

EUR/USD – The EUR/USD beat expectations with Fridays close above 1.38 making a strong bullish case for the pair. However 1.38 marks a falling monthly trend line. Therefore caution is advised until a daily close is registered above this level.

USD/JPY – The pair broker lower to close below the rising trendline on global risk aversion. USDJPY ended the week at 101.72. We maintain a broader bullish outlook although next week will be driven by risk trends. Support sits at 101.63 and 101.26.

USD/CHF – We mentioned key support last week as 0.8797 and USDCHF collapsed to close directly on this level. Give the current one of the markets we would look for a close below this level to see falls accelerate. Support sits at 0.8839 and 0.8800.

GBP/USD – The pair moved higher in volatile trading over the week to end at 1.6740. The start of the week could see a pullback from this level. An early move higher at the start of the week brings 1.6800-1.68500 in to focus as a target.

Major Indices

DOW – The Dow Jones pushed higher over the week but failed to close above previous resistance at 16400. Ending at 16321 the outlook remains constructive though we would look for a break of 16400 to confirm a bullish scenario. Support sits at 16200.

NASDAQ – More gains for the NASDAQ over the week with a close at 4308 as the index continues to carve out fresh gains. The outlook continues to remain bullish. 4350 is the next level of interest while 4250 offers first support.

FTSE – For a second week the Index failed to close above 6850 level, ending down on the week. Closing at 6809 we remain broadly bullish on the index. However a close above 6850 is needed to provide conviction to this reading.

Commodities

Oil – The Crude price oscillated in a tight range last week between support at $101 and recent highs just above $103 per barrel. Following recent gains on the weekly candles we expect further consolidation before the next move higher. $101 is support.

Gold – Testing $1350, the Gold price pulled back over the week to end at $1326. While we remain longer term bullish this market, the current technical setup indicates the potential for further near term pullbacks. Support kicks in at $1300 and $1280.

Stocks

A lot of UK companies reporting this week but nothing of note for those trading stocks from Binary Options Brokers.