Trading strategies focused on breakouts have long been used by traders around the globe. They provide a reliable and easy to set up and implement approach to trading that can yield very good results.

The core concept behind a breakout system is the identification of a price level or range that the current price will ‘break through’ as it moves into a new trading range.

The objective is to identify the breakout level, anticipate the break and then enter the market when it confirms in the direction of the price breakout.

Binary Options Breakout Trading Strategy Theory

A classic breakout trading strategy relies on two things for success.

The first is the need to correctly identify a suitable breakout level. The temptation for new traders is to view every support and resistance level on the chart as appropriate levels to trade. However such an approach is unlikely to lead to long term success.

It is important that you identify strong market levels or potential ‘break points’. The stronger the level the more likely it is that a break will see the strong move required. Levels that have previously provided support (or resistance) will often prove the most successful to trade.

The second requirement leads on from the first. You need sufficient momentum in the market for the break to succeed. While identifying strong breakout levels will help, you are also going to need strong market volume to push the move.

Trading at times of low liquidity or at the end of a market sessions is unlikely to prove as successful as trading say a morning breakout strategy for Forex on Forex when volume is high and moves are more likely to carry through.

When trading with binary options a third variable comes into the mix. This is timing. This is important as you need to time the expiry of your trades correctly so as to avoid any pullbacks or whipsaws which can occur as part of the break or if the move turns out to be weaker than expected.

Entry Signal

Breakout trading is actually quite simple to execute and doesn’t rely on any complicated technical indicators. In fact a simple chart is really all that you need to get started.

Identifying levels for an entry can be done well in advance of the scenario playing out. What you need to look for are suitable ‘break levels’ where the market is likely to push into a new price range if breached.

If the price of an asset moves beyond the identified level, then the assumption is that the break has happened and momentum will continue to propel the price in the direction of the break. We simply open our trade once the break has confirmed and place it to expire in the direction of the break. Simple huh?

Trade Timing

Of course the theory is simple, but it can prove harder to implement such a strategy reliably on your account.

Identifying the correct level for a breakout is one part of the equation. Determining where the price will be at the expiry of the binary option contract is another.

This is not such an issue for traders making use of Spot Forex trading, Spread Betting or CFD’s. This is because they can book pips etc along the way or identify levels to take profit. However when trading higher or lower with binary options you need to give some thought as to how strong the move is and when you want your contract to expire.

Just because we predict the move correctly, we can still end up losing the trade, simply because we don’t trade the right contract and so end up on the wrong side of the barrier.

There is of course no specific answer to this. However if the break is strong enough then making your higher or lower call should keep you fairly safe. Also the higher the timeframe that you trade the more likely the move will stick.

Breakout Trading Strategy Example

Taking into account the above I tend to look for strong breakout levels on currency pairs on high timeframes. I favour currencies as they tend to show the level of volality that is needed for breakouts. I also find they tend to throw up more breakout trading opoportunies than stocks.

Here are a couple of examples of breakout conditsion on currency pairs that I traded. The first is a simle morning breakout that occurred at the London Open. Here I favoured the GBP/USD pair as it tends to react well at this time of day.

You can see that the pair has traded in a range over the prior Tokyo session. I identify the top of this box range as being a level that, if breached should see plenty of follow though momentum at this time of day.

I watched the chart and waited to see if the break would happen. Sure enough it did and once it had confirmed on the next candle I entered the position with an end of day expiry.

I like the end of day binary option expiry contract. It seems to combine well with the reading from the hourly chart. Remember I am looking for market levels where a break still see strong momentum that will carry the price in the direction of the break by the end of the day.

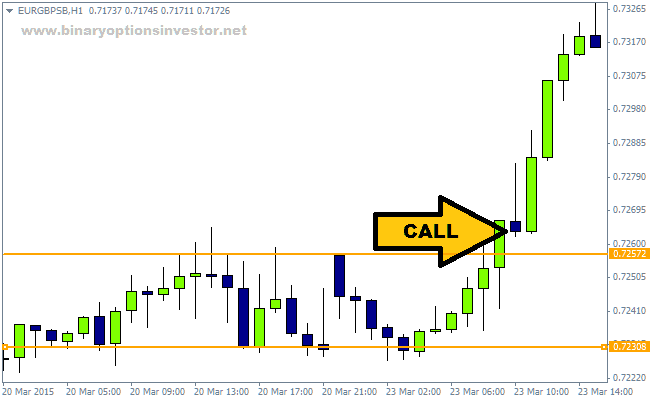

The second example shows another example how you can trade a breakout by identify range bound price trading. A break of the identified upper or lower limits of this range on the EUR/GBP pair offers the potential to trade in the direction of the break.

As we can see on the chart the move happens towards the start of the session. the pair breaks higher. A Call Option is placed to expire at the end of the day.

Note that even if I had waited for confirmation of the move by checking on the closure of the second candle, there was still plenty of momentum in the move to ensure a profitable breakout trade by the end of the day.

Points to Consider

Try to identify levels where you anticipate large stop orders to have built up. As momentum pushes the price into these orders they will trigger and accelerate the move. This will help to propel the price away from the breakout level and into a new trading zone.

While timing is important it is vital that you pick the right market to trade. As already mentioned, Forex tends to be more volatile and therefore better suited to breakout trading systems. Remember that you need an asset that has a decent amount of movement over your time frame to sufficiently move the price on a break.

It can be tempting to anticipate the break to early without letting it confirm. Obviously if this happens then you are going to be locked into a position as your contact goes underwater.

It is easy to say ‘wait for confirmation of the move’ but his is hard to define. It will also depend upon the asset traded and on the flip side, the longer you leave your entry, the more of the move you are likely to miss.

Creating s profitable breakout strategy for binary options requires a fine balancing act. A good technique is to drop to a lower level chart and wait for the close of the next candle. This can be used to confirm if the breakout is for real or simply a false move.